A BronCore Fitness bootcamp in the Boston Commons. Bron Volney Jacob Gise opened a Body Fit Training franchise in Santa Monica, California, in November. By March, the flagship U.S. studio of the global chain had just become profitable. Gise had traveled to Australia, where Body Fit Training began, to learn […]

Shelander said Dr. Crandall and Associates started looking into the idea of installing negative pressure rooms in March when the state first shut down due to the pandemic. “The dental industry, we have actually been identified as one of the highest, if not the highest at-risk industry for COVID transmission,” Shelander said. […]

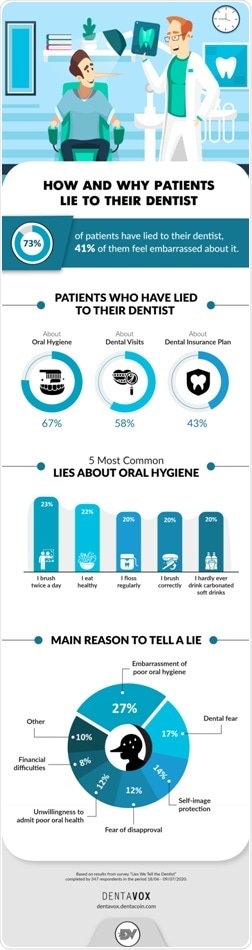

Jul 24 2020 According to recent results from a DentaVox survey, for the majority of patients, lying to their dentist is a common practice despite the substantial share of them (41%) who feel embarrassed about it. In most cases, patients are dishonest about neglecting oral hygiene habits or indulging in […]

Treasurer Josh Frydenberg says the Morrison government is “favourably disposed” to extending the coronavirus supplement dole payment beyond Christmas. The government last week extended the JobSeeker supplement beyond its legislated September cut-off until the end of the year, although it will be reduced from $550 to $300, bring the overall […]

Jobless Long Islanders say they fear the worst when the extra $600 in weekly unemployment benefits they’ve been receiving comes to an end this weekend. Unless Congress acts to extend the bonus, authorized through July 31 as part of the $2.2 trillion CARES Act, Sunday will mark the end of the final […]

Click here to read the full article. “Now is a time when health is top-of-mind for a lot of people, whether that’s on purpose or subconsciously,” said Nina Mullen, on the effects of the coronavirus pandemic, speaking at Beauty Inc’s inaugural virtual Wellness Summit. “We see people investing a lot […]